Deleted member 403

Guest

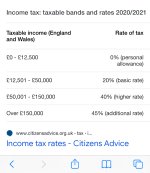

What are the tax laws in your country for income? I live in the United Kingdom and most of us have to contribute to the system unless your warning under 12,500 pounds a year.

Do you think COVID will have a negative impact and cause taxes to go up? Would this be a good decision that the governments could make?

Do you think COVID will have a negative impact and cause taxes to go up? Would this be a good decision that the governments could make?